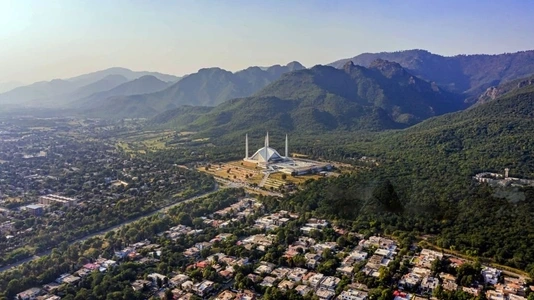

Pakistan’s auto market is one of the smallest yet fastest-growing in Asia. It is the 35th largest producer of automobiles. The automotive industry in Pakistan has experienced rapid growth, with a 171% increase between 2014 and 2018, contributing 2.8% to the country’s GDP and providing employment to more than 3.5 million people as of 2021. The industry’s contribution to the national treasury is approximately Rs. 30 billion. However, due to austerity measures, car sales decreased from 269,792 in 2018 to 186,716 in 2019.

History

Prior to 1972, the automotive industry in Pakistan was largely dependent on imported vehicles and had limited domestic production. It was not until the industry was nationalized in 1972 that the government began to actively promote its development and domestic production. The nationalization resulted in a complete overhaul of the industry, with private companies like General Motors Pakistan, Toyota Pakistan, and Atlas Honda being converted into state-owned enterprises. Additionally, the government established new companies like Heavy Industries Taxila (HIT), which focused on manufacturing military vehicles and equipment.

The 1970s and 1980s saw significant growth in the Pakistani automotive industry, thanks to government incentives and subsidies aimed at boosting domestic production. During this period, the industry diversified its offerings and began manufacturing cars, trucks, buses, motorcycles, and even plastic parts, with companies such as SPEL and Awami Motors assembling popular models like the Suzuki Pick-Ups and Sindh Engineering Mazda Trucks. Al-Ghazi Tractor introduced Fiat Tractors in 1980, and Hinopak Motors Limited was formed in 1986 through a joint venture between PACO, AL-Futtaim, Hino Motors & TTC. Gandhara Nissan also entered the market in 1987 with the production of Nissan Diesel Trucks.

Privatization

In the 1990s, the Pakistani government initiated the privatization of the automotive industry, resulting in the sale of many state-owned enterprises to private companies. This shift paved the way for the entry of new players in the market, including Dewan Farooque Motors, which introduced the Shehzore pickup truck, and Hyundai-Nishat, which began producing Hyundai vehicles in Pakistan. The privatisation also led to the production of popular models like the Toyota Corolla by Indus Motor and Honda Civic by Honda Atlas.

Recent growth

In the 2000s and late 2000s, the Pakistani automotive market continued to grow with sales increasing by more than 50%. This growth was fueled in part by the 5-year automotive policy of 2016-2021, which attracted new producers to a market traditionally dominated by Honda, Toyota, and Suzuki. Notably, United Motors became the first local car manufacturer, while Ghandhara Nissan began producing the Isuzu D-Max in Pakistan.

New auto policy

The New Auto Policy of 2021 to 2026 was introduced in Pakistan, which aimed to incentivize new automakers to establish manufacturing plants in the country. The policy offered tax incentives to attract foreign investment and encourage local production. As a result, several global automakers, including Renault, Nissan, Proton Holdings, Kia, SsangYong, Volkswagen, FAW, and Hyundai, have expressed their interest in entering the Pakistani market.

MG JW Automobile Pakistan signed a memorandum of understanding (MoU) with Morris Garages (MG) Motor UK Limited, a subsidiary of SAIC Motor, to introduce electric vehicles to Pakistan. Meanwhile, the National Logistics Cell (NLC) signed an agreement with Mercedes Benz for the local manufacturing of Mercedes Actros trucks in Pakistan.

In July 2022, Jolta Electric launched the production of electric motorcycles, demonstrating the industry’s continued growth and shift towards electric vehicles in Pakistan. With the introduction of new players and investment, the Pakistani automotive industry is poised for significant expansion in the coming years.

Current challenges

The automotive industry of Pakistan started facing a critical phase in July 2022 when the government imposed sudden restrictions on the import of completely knocked down (CKD) units and parts due to the looming threat of default. This decision was made without consulting the industry’s stakeholders, leaving them in a difficult position. However, the government later introduced an import quota regime based on 50% import performance, which somewhat met the industry’s needs.