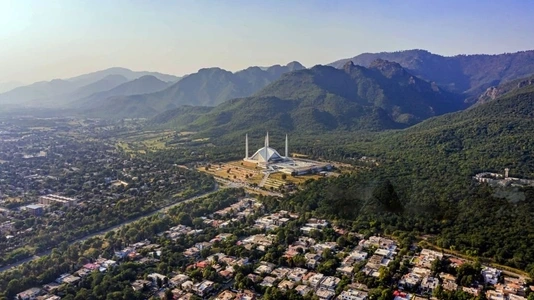

The real estate sector in Pakistan holds significant importance, contributing around 60 to 70% of the country’s total wealth, with an estimated value of $300 to $400 billion. This industry encompasses a range of activities, including constructing, developing, managing, and selling residential, commercial, and industrial properties. It is a key contributor to Pakistan’s GDP, accounting for about 2%, and is the second-largest employment generator after agriculture. The sector’s impact extends beyond direct employment, as it stimulates demand for over 400 industries, from construction materials to financial services like house financing.

Since 2018, the real estate industry in Pakistan has faced substantial challenges, primarily due to increased taxes and stringent measures introduced by the government to promote investment transparency. Consequently, the sector has grappled with economic, financial, and political difficulties, resulting in policy uncertainties and decreased confidence. These challenges have led to the closure of many real estate consultancy offices, affecting millions associated with the industry.

The Federal Board of Revenue (FBR) has implemented strict regulations, such as barring non-filers from property purchases, mandating registration for property transactions exceeding PKR 5 million, and imposing high taxes on property transfers. These measures have deterred potential investors, creating uncertainty and prompting some to explore investment opportunities in other countries. Countries like the UAE and the UK, offering more favorable incentives, have attracted foreign exchange that might have otherwise gone into Pakistan’s real estate.

Interestingly, overseas Pakistanis have invested significantly in the industry, often channeling remittances into real estate due to restrictions on other businesses. The State Bank of Pakistan reports around USD 21.84 billion in remittances during 2019-20, largely from overseas Pakistanis and mainly into the real estate sector. However, excessive regulation has also hindered overseas investors, leading to a reduction in remittances to Pakistan.

Key challenges faced by the Pakistani real estate industry include:

- Non-Execution of Developmental Budgets: The failure to implement budgets for real estate projects has contributed to the sector’s decline, leading to abandoned projects and economic hardships.

- Strict Tax Policies: The FBR’s policies targeting tax non-filers, including withholding taxes on banking transactions, have discouraged investors and brokers, impacting the entire industry.

- Overseas Investment Hurdles: Policies that demand the physical presence of overseas Pakistanis for transactions deter them from investing in the real estate sector.

- Lack of Education and Guidance: A lack of education among agents and dealers has given rise to fraudulent practices. This dissuades overseas Pakistanis from investing due to concerns about losing their funds.

In conclusion, Pakistan’s real estate industry is a vital component of the country’s economy, offering growth potential and employment opportunities. However, challenges such as developmental budget mismanagement, strict tax policies, fraudulent practices, and lack of investment transparency have hindered its progress. Addressing these challenges requires the government to implement investor-friendly policies, enhance transparency, and promote education within the industry. By doing so, Pakistan can foster a stable and flourishing real estate sector that benefits both the economy and its citizens.